Managing your money while studying abroad is one of the most important skills to master — especially in a country like Australia where the cost of living can be high depending on the city you choose. Whether you are enrolled in a full-time degree or a short course understanding how to manage your finances will ensure you stay within budget avoid debt and enjoy your experience to the fullest.

In this complete guide we break down practical strategies on how to manage your finances in Australia as an international student in 2025 including budgeting student discounts work rights bank accounts and more.

Why Financial Planning Matters for International Students

Moving to a new country means taking full control of your financial life. With expenses like tuition fees accommodation groceries transport and entertainment — the total monthly costs can be overwhelming without a proper plan.

Good financial planning helps you:

- Avoid running out of money

- Build savings for emergencies

- Reduce financial stress

- Enjoy a better quality of life

Read More: Australian Student Visa Requirements for Indian Students 2025: Complete Guide

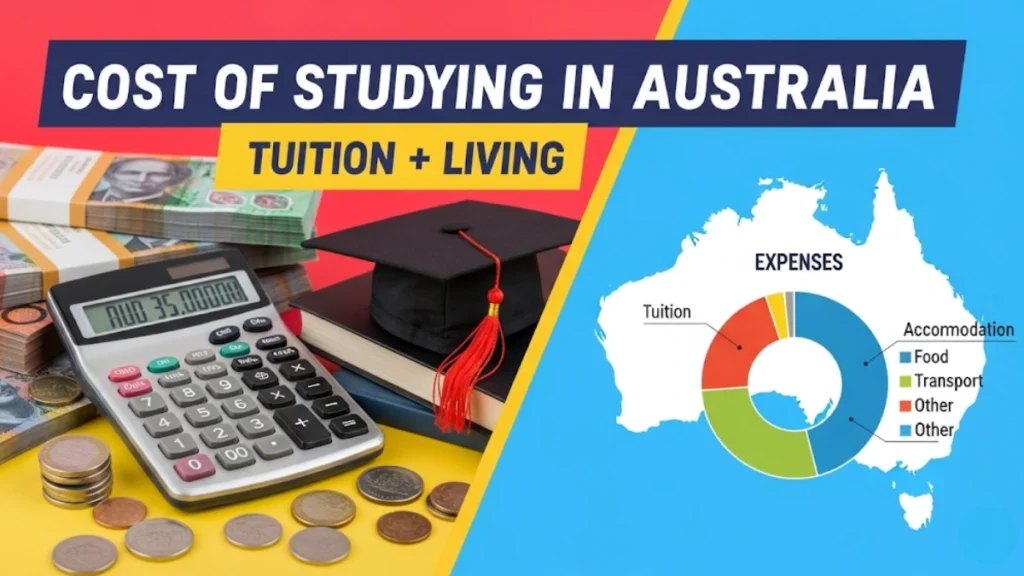

Understand the Average Cost of Living in Australia

Before setting a budget you need to know what to expect. Here’s a rough estimate of monthly expenses for students living in major cities in 2025:

| Expense | Average Monthly Cost |

| Rent (shared) | AUD 700 – 1 200 |

| Groceries | AUD 300 – 500 |

| Transport | AUD 100 – 200 |

| Utilities & Internet | AUD 100 – 150 |

| Mobile phone | AUD 30 – 50 |

| Entertainment | AUD 100 – 200 |

| Total | AUD 1 300 – 2 300 |

Your spending may vary based on your lifestyle city and accommodation type.

Create a Simple Monthly Budget

A budget helps you control your spending and keep track of where your money goes.

How to Make a Budget:

- List your monthly income: This includes money from family part-time jobs scholarships or savings.

- Track your fixed expenses: Rent tuition insurance etc.

- Estimate variable expenses: Groceries entertainment and transport.

- Set spending limits for non-essential items.

- Use budgeting tools like Excel Google Sheets or free apps like Frollo Goodbudget or Pocketbook.

Open a Student Bank Account

Once you arrive in Australia open a local student bank account to avoid international fees and manage funds easily.

Popular student-friendly banks:

- Commonwealth Bank (CBA)

- ANZ

- Westpac

- NAB

These banks often offer fee-free accounts for full-time students. You’ll need your passport student visa Confirmation of Enrolment (CoE) and local address to open an account.

Use Student Discounts Everywhere

Being a student in Australia gives you access to a wide range of discounts on food clothing entertainment transport and more.

Where to find student discounts:

- UNiDAYS and Student Edge: Free to join offer deals on tech fashion fitness and more.

- Public transport cards: Concession fares for full-time students in most states.

- ISIC Card: International Student Identity Card for global and local discounts.

- University ID: Always ask if there is a student rate.

Find Affordable Accommodation

Accommodation is usually the biggest expense. Choose the right housing option to save money.

Budget-friendly housing types:

- Shared apartments or houses: Most cost-effective.

- University dormitories: Convenient but can be expensive.

- Homestay: Live with an Australian family with meals included.

- Purpose-built student accommodation (PBSA): Offers safety and community but often costs more.

Pro tip: Use websites like Flatmates Gumtree or realestate.com.au to find cheaper housing options.

Cook Your Own Meals

Eating out in Australia is expensive. One simple way to cut costs is to cook at home.

Benefits of home-cooked meals:

- You can save AUD 200–300 per month.

- You eat healthier.

- You get to enjoy your local or cultural food.

Shop at budget-friendly stores like ALDI Woolworths or Coles and cook in batches to save time and money.

Work Part-Time to Support Your Living

International students can work up to 48 hours per fortnight during term and unlimited hours during breaks (as of 2025).

Popular student jobs:

- Retail staff (e.g. supermarkets stores)

- Hospitality (cafes restaurants)

- Tutoring

- Uber Eats or food delivery

- Admin or university jobs

Make sure your job doesn’t interfere with your studies. You must also apply for a Tax File Number (TFN) to work legally.

Take Advantage of University Support

Most universities in Australia offer free financial counseling and student support services.

Services include:

- Budgeting advice

- Emergency loans or grants

- Food pantry programs

- Career support to help you find part-time work

Always reach out to your university’s student support center when facing financial pressure.

Avoid Unnecessary Debt

Many students get tempted by credit cards loans or Buy Now Pay Later (BNPL) services.

Unless absolutely necessary avoid borrowing because:

- Credit card interest rates in Australia can be very high (up to 20%).

- It’s easy to fall into debt.

- Debt can affect your visa or PR application later.

If you must use a credit card choose student cards with no annual fee and always pay off your balance in full.

Build Emergency Savings

Life in a foreign country can be unpredictable. It’s smart to have a small emergency fund of AUD 1 000 – 2 000 for:

- Medical emergencies

- Job loss

- Accommodation problems

- Unexpected travel

Save a little from each paycheck and keep this money in a separate savings account.

Use Free or Low-Cost Entertainment

You don’t have to spend a lot to have fun in Australia. Many cities offer free or cheap events and activities for students.

Free things to enjoy:

- Public beaches and parks

- Student festivals and networking events

- Free university gym access (in some cases)

- Museums galleries or local sightseeing

Look for Facebook groups or city websites that post upcoming free events.